Long-Term Care

Your goal for an initial long-term care planning conversation should be to simply confirm the need to create a plan. Don't make it about price or start with a quote for an insurance-based product.

If you've had a good conversation that led to the possibility of using long-term care insurance, we'd love to talk to you about your client's goals, funding strategies and health. You can call us, use the LTC PreView tool on the Ash Advisor Portal, or start by completing our LTC quote request form.

LTC underwriting depends on what medical conditions your client has and how well-controlled they are. Although we can’t be sure of what’s in a client’s records, pre-qualifying your client is the best way to get a realistic idea of approval. Our LTC PreView tool is a great way place start.

Don't make it about insurance, product or cost. Start a planning conversation to determine their goals and mindset.

You can find conversation starters and ideas for overcoming objections in our LTC Conversation Guide.

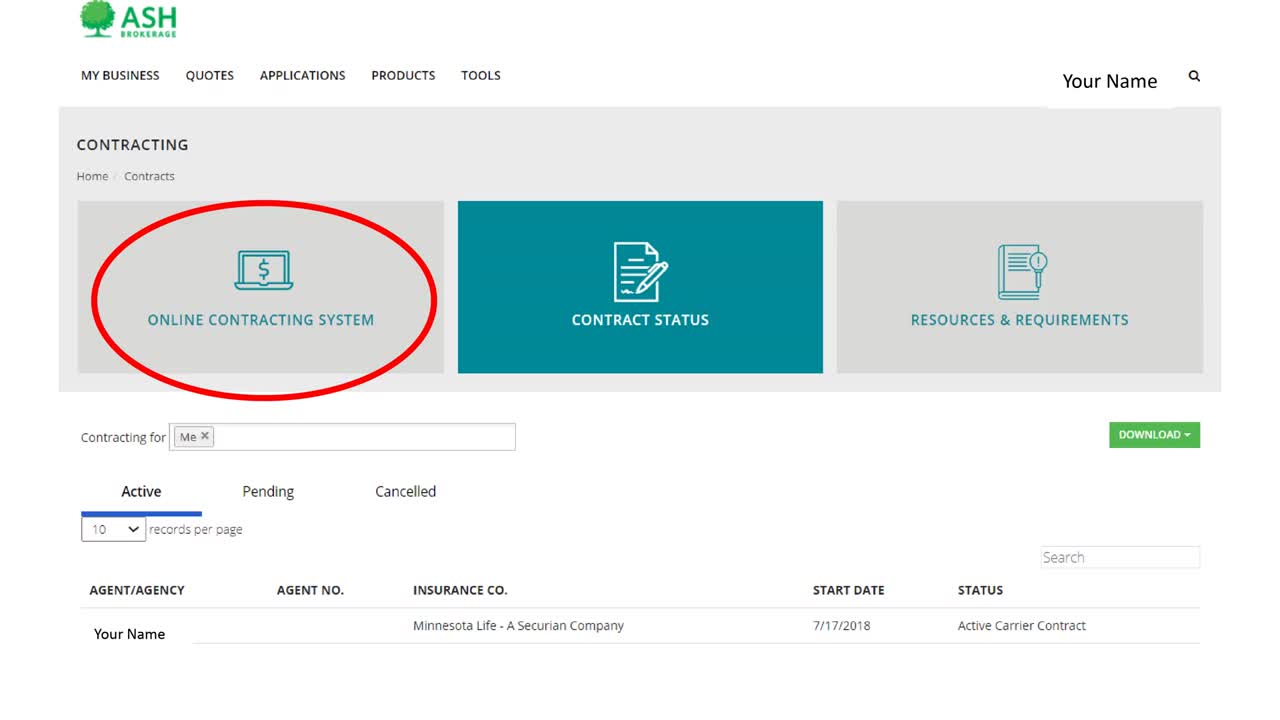

Everything is done online through an electronic contracting system called SureLC. You'll want to log in to the Advisor Portal. From the homepage, click on the Contracting tile, then choose Online Contracting.

For the initial setup, your information pulls directly from the National Insurance Producer Registry – it may be as easy as verifying no changes are needed or completing your profile that includes submitting your signature card, Errors and Omission coverage, AML, and if directly paid, direct deposit information.

After setting up your initial profile with our online contracting system, you can request additional insurance carrier contracts at the click of a button. You can also update any contracting documents such as AML, E&O, or bank information. No more unnecessary duplication of efforts, redundant questions or searching for up-to-date paperwork. It’s fast, paper-free, and it’s always available when you need it.

If you need help, our Commissions and Contracting team is available to make sure the insurance process never stands in the way of progress.

Most individuals who need ongoing care require assistance with day-to-day living, not skilled medical attention. Medicare only covers skilled care after hospitalization, which would not help in those circumstances. It’s designed to pay for severe, short-term illness only.

Medicaid is essentially a welfare system – and it feels like it. If your client’s plan for long-term care is to spend their entire life savings, only to end up on welfare, then why plan for retirement at all?

For more information on how to guide clients through a planning discussion, check out our Conversation Guide to Long-Term Care or contact us.

Partnership plans are LTC policies that meet state guidelines and are designed to make it easier to qualify for Medicaid after exhausting private LTC benefits. In most states, every $1 of received LTC benefits protects $1 of the client’s assets from spend-down should the client need Medicaid later. The client still needs to meet all other eligibility requirements, and careful attention should be paid when the client purchases the policy in one state and wants to use it in another.

We are available to join you on client calls and walk you and your client through the different parts of an illustration, answer questions and help you both feel confident about what’s being quoted. Just talk to our LTC team to schedule time.

That depends on your client’s goals and funding. Talk with your client about what they want to do and then select the type of coverage that meets those goals best.

Absolutely. Traditional LTC appeals to clients interested in robust coverage and the ability to customize coverage.

Although wealthy clients can choose to self-insure, it’s usually more cost-effective to transfer at least some of the risk to an insurance company.

We have carriers that will write up to age 79 for traditional coverage, 80 for linked benefit based on life insurance and age 85 for lined benefit based on annuity coverage. Benefits might be limited at older ages, and health conditions can make it harder to qualify.

What they should NOT do is cancel their coverage. Instead, talk with our LTC team about the case. We can help with ways to modify benefits and keep the coverage in force.

In most circumstances, cash value can be transferred with a 1035 exchange to a hybrid life insurance policy. By using a 1035 exchange, the client doesn’t experience a taxable event.

Unlike life insurance, LTC costs are lower if someone lives for a shorter time. Since women tend to live longer than men and use more long-term care benefits, it costs more to cover them. And that means higher rates.

A 1035 exchange is the exchange of an insurance contract for another that meets all the requirements of Section 1035 of the Internal Revenue Code (IRC 1035). When a contract is exchanged under IRC 1035, the gain or loss of the exchanged contract is transferred to the new contract. Requirements for non-taxable treatment include:

- The owner and the insured/annuitant on both contracts must be identical

- The contract being exchanged must be in force. If the contract is maturing, the 1035 exchange must be signed prior to the maturity date